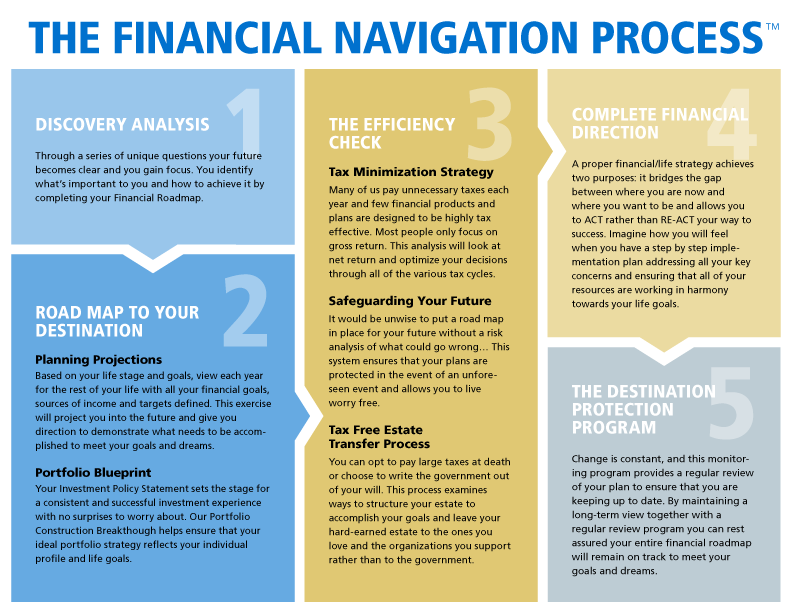

Our Financial Navigation ProcessTM

Our Financial Navigation ProcessTM is about providing a higher level of planning, providing a unique experience to clients that will accomplish two things:

- Enable you to be crystal clear about those things in life that are most important to you.

- Give you tremendous confidence from knowing you are making smart choices with your money… and seeing the impact on a regular basis.

Discovery Analysis

One thing we know is that critical events arise and can have a profound impact on people’s lives. These events are sometimes predictable and planned but our experience tells us that they are often random. Being prepared for the different events that can occur will give you a greater peace of mind.

Types of Critical Financial Events

- Retirement (Retirement income projections)

- Changing careers or employers

- Loss of spouse

- Starting & growing a business

- Illness or Disability

- Succession & sale of a business

- Inheritance

- Travel & Hobbies

- Birth of child or grandchild

- Cottage or Vacation Home

- Post Secondary Education

- Sale of property or assets

- Divorce

- Leaving a Legacy

Every life will have its own pattern of these events. By being prepared and having a flexible plan, we can help you make your life less stressful and as a result, much happier. Flexibility is the key to a successful long-term plan.

Crafting a Financial Plan

Planning Projections

Based on your life stage and goals, view each year for the rest of your life with all your financial goals, sources of income and targets defined. This exercise will project you into the future and give you direction to demonstrate what needs to be accomplished to meet your goals and dreams.

Investment Portfolio

Your investment plan sets the stage for a consistent and successful investment experience. Our Portfolio Construction Breakthrough helps ensure that your portfolio strategy reflects your individual profile, goals, and risk tolerance to keep you invested and generate the returns your plan relies on.

The Efficiency Check – Risks, Opportunities

Tax Minimization Strategies

Many of us pay unnecessary taxes each year and few financial products and plans are designed to be highly tax effective. Most people only focus on gross return. This analysis will look at net return and optimize your decisions through all of the various tax cycles.

Risk Management

It would be unwise to put a road map in place for your future without a risk analysis of what could go wrong. This system ensures that your plans are protected in the event of an unforeseen event and allows you to live worry free.

Estate Transfer Process

The effectiveness of estate planning always improves dramatically given enough time and focus. This awards you with the valuable opportunity to engage in a meaningful distribution of your assets, to plan for a tax-efficient transfer of wealth to your heirs, using money as an expression of love.

Complete Financial Direction

A proper financial/life strategy achieves two purposes: it bridges the gap between where you are now and where you want to be and allows you to ACT rather than RE-ACT your way to success. Imagine how you will feel when you have a step-by-step implementation plan addressing all your key concerns and ensuring that all of your resources are working in harmony towards your life goals.

Destination Protection

Change is constant, and this monitoring program provides a regular review of your plan to ensure that you are keeping up to date. By maintaining a long-term view, together with a regular review program, you can rest assured your entire financial roadmap will remain on track to meet your goals and dreams.