We are guided by the following ideals:

- We keep your information confidential while fulfilling our professional duties with the utmost integrity.

- We are people you can rely on, through good times and bad.

- We not only listen, but strive to hear what you have to say. We understand that investing is an emotional roller coaster and will help you modify any inappropriate behaviour so that you are successful.

- We will always look out for your best interest by providing you with unbiased recommendations based on your needs and goals.

- Finally, we follow a disciplined process which will lead to success. We aim to implement this process with clients using appropriate financial products for their needs offered at a cost that is generally lower than the competition.

How We Help Clients

It is our strong belief that to be successful in reaching your goals it is necessary to have a plan in place and to follow a process. That is, to make your life and financial decisions not by accident but by design. Remember, successful people ACT towards the future they want! We try to help clients by leading them towards their goals and do this by following our guiding principles and proven practices in investment management.

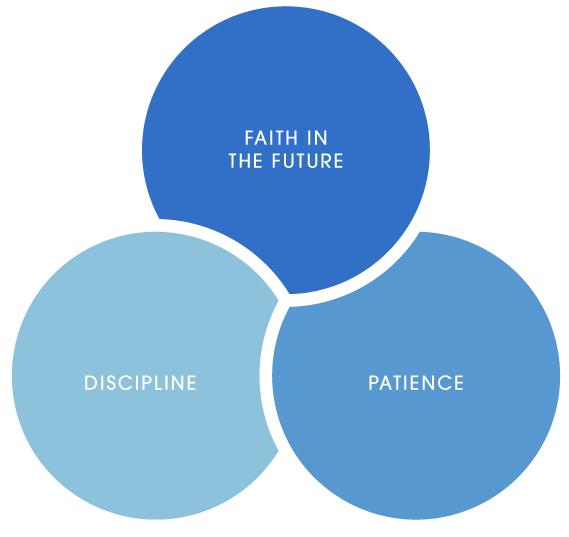

Our 3 guiding principles are easy to understand and are really more of a mindset required for success.

Faith in the future

We believe in tomorrow! Having faith in the future is the only outlook that squares with the past and our own life experiences.

Patience

Rome was not built in a day. It is important to realize that there are huge odds that you will have a 20 – 30 year retirement. That’s the good news. Now is your money going to outlive you or are you going to outlive your money? Most peoples investment time horizon is much longer than they think!

Discipline

Have a plan and stick with it. All success comes from sticking to a plan and not re-acting to events. Modifying inappropriate behaviour and exercising self-control is critical to long term success. A proper strategy without self-control is like having a fitness program without discipline – long on promise and short on results. We help you stay in control!

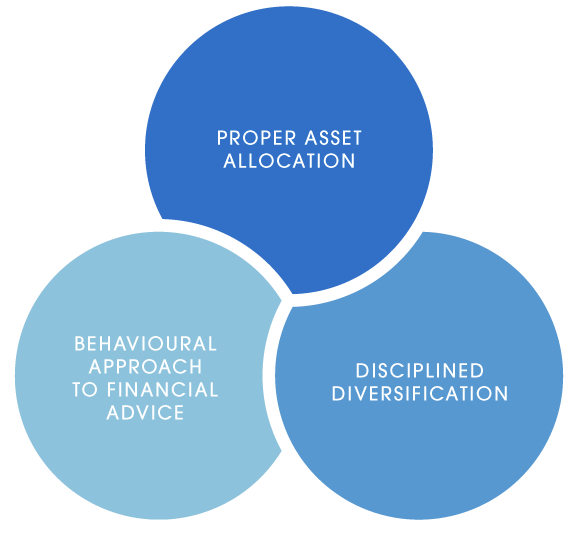

We follow 3 proven practices for investment management that will persevere through all market cycles.

Proper Asset Allocation

Our aim is to balance risk and reward by setting up your portfolio according to your goals, risk tolerance and investment horizon. 90% of your long term returns will be driven by this decision.

Disciplined Diversification

Don’t put all your eggs in one basket and don’t follow trends. We won’t let you chase yesterday’s story and lose the diversification required to guarantee success.

Timely and Disciplined Rebalancing of Assets

Any portfolio’s mix will drift over time as prices move in different directions. Sound portfolio management is founded on “buy and rebalance” which involves selling some of what has just done relatively well and buying those assets that have lagged.

Why Are Our Principles And Practices So Important?

It is proven time and again that there is a huge variance between Investment performance and Investor performance. That is to say that investment returns over time have tended to be dramatically higher than what most Investors actually earn. This is generally due to a lack of following guiding principles and practices and reacting to external events. Given the chance, we will educate our clients on the importance of following these principles and practices and taking control of their future.