For those of us who will need to live off the assets we have accumulated over our working years, one of the most important milestones occurs when we start converting our savings into income. In our view, for most people this is the most important crossroad in their financial lives and one that needs careful planning to ensure success.

The 4 Key Steps to having a solid plan are:

- List your sources of income in retirement. This would include CPP, OAS, pension and any other income sources to be relied upon during retirement.

- Estimate your expenses including taxes. A simple worksheet where you track your expenses today and then use that as a base for estimating what they will be in retirement can help with this task.

- Calculate the gap that will occur each year between expenses and income; this can vary over the years. Determine how much money you will need each year (including inflation) to live the life you have targeted.

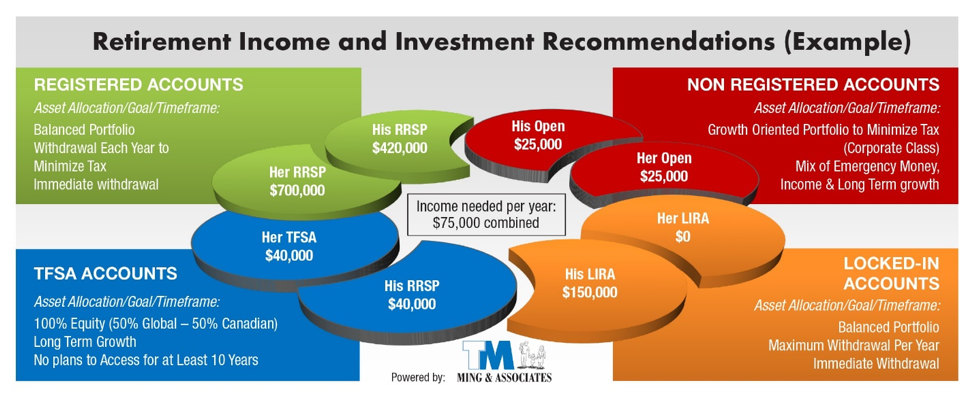

- Prepare a plan for all of your investments. Determine when and where you will need to access money from various types of investments. Set up an investment plan for each type of account to meet these needs.

With a properly prepared and implemented retirement income plan you can be assured that you are making the best use of your savings and paying the least amount of tax. If you are unsure of your current plans or want help please let us know.