With so many sources contributing to a households’ retirement income in Canada, many pre-retirees have a hard time wrapping their head around how far their savings can take them in retirement. When we are preparing retirement projections, as you may imagine the #1 question is “How long will my money last?”

Let’s take it one step further. We’ll look at two couples, one with $500,000 in savings and one with $1,000,000 in savings and both are planning to retire this year at 65

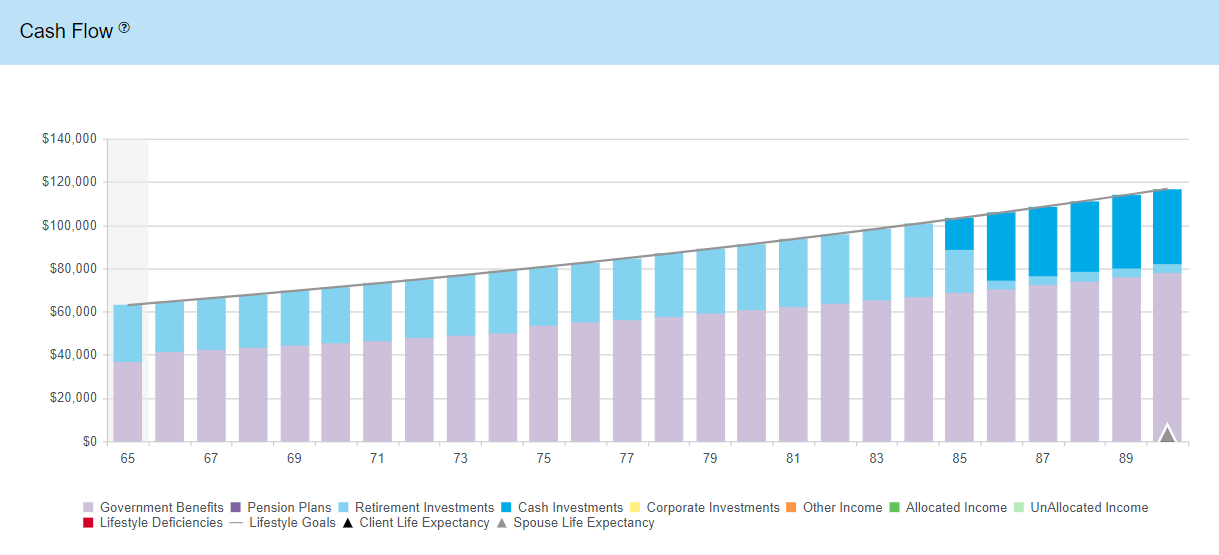

John and Anita’s Retirement Income Scenario to Retire @ 65 with $500k saved:

Retirement Savings:

- RRSP (Registered Retirement Savings Plan):

- John has $285,000 invested in a balanced portfolio.

- Anita has $115,000 invested in a balanced portfolio.

- LIRA (Locked-In Retirement Account):

- Anita has $60,000 invested in a balanced portfolio.

- TFSA (Tax-Free Savings Account):

- John and Anita both have $20,000 in their TFSA’s invested in a growth portfolio.

Government Benefits:

- CPP (Canada Pension Plan):

- John and Anita are both eligible to receive CPP, each is estimated to receive $1,000 per month @65 ($2,000 per month combined) and start at 65.

- OAS (Old Age Security):

- Each is eligible to receive the maximum OAS amount, or $713 per person ($1426 per month combined) and start at 65.

Total Retirement Income (after tax) = $63,000/year or $5,250/month

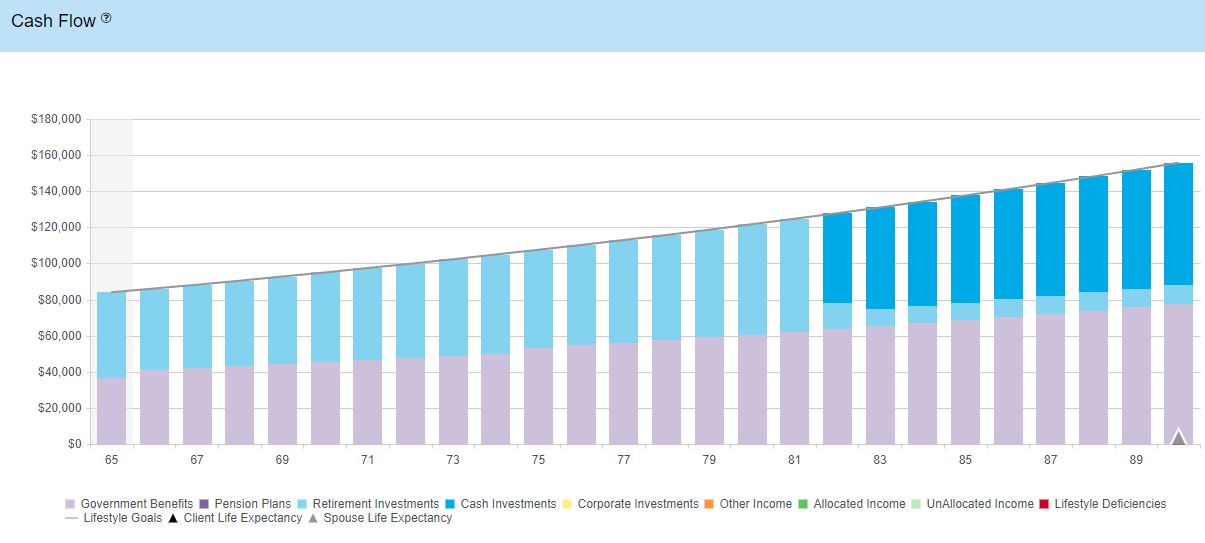

John and Anita’s Retirement Income Scenario to Retire @ 65 with $1,000,000 saved:

Retirement Savings:

- RRSP (Registered Retirement Savings Plan):

- John has $445,000 invested in a balanced portfolio.

- Anita has $245,000 invested in a balanced portfolio.

- LIRA (Locked-In Retirement Account):

- Anita has $140,000 invested in a balanced portfolio.

- TFSA (Tax-Free Savings Account):

- John and Anita both have $85,000 in their TFSA’s invested in a growth portfolio.

Government Benefits:

- CPP (Canada Pension Plan):

- John and Anita are both eligible to receive CPP, each is estimated to receive $1,000 per month @65 ($2,000 per month combined) and start at 65.

- OAS (Old Age Security):

- Each is eligible to receive the maximum OAS amount, or $713 per person ($1426 per month combined) and start at 65.

Total Retirement Income (after tax) = $84,000/year or $7,000/month

It is important to understand that the timing of government benefits is a crucial aspect of retirement income planning as your benefit amount depends on the age you begin*

Read more here: https://mingassociates.com/webinar-recordings/

What if they started CPP @ 60? It would reduce their retirement income by nearly $6000/year for the rest of their life (from 65 on).

What if they delayed CPP & OAS to 70? It would increase their retirement income by over $2000/year for the rest of their life (from 65 on)

Key Assumptions unchanged in both scenarios

- Joint life expectancy of 92.

- Portfolio rate of return of 5%

- Inflation rate of 2.5%

- John and Mary maintain an emergency fund for unexpected expenses.

- They have paid off their mortgage before retirement.

This scenario is a simplified illustration, and individual circumstances may vary. It highlights the combination of retirement savings & government benefits to create a balanced and reliable retirement income for the Canadian couple, John and Anita.

Retirement projections are one of the most valuable tools we have to help retirees visualize the life they want to live and enjoy spending their money without constant fear.

To learn more, visit https://mingassociates.com/services/retirement-projections/