With the Super Bowl “kicking” off this past weekend, no doubt many of you witnessed the continued obsession self-directed platforms put on “Retiring 30% Wealthier”. If you have seen these ads, it would suggest you would do well with them. The constant undermining of “Dad’s Guy” has led us to write this post – debunking the promotional ads that discount the value of financial advice.

Our team feels that investors deserve to see the transparency of these products;

They’re low cost, right?

Yes. The actual on-going Management Expense Ratios and management fees for some self-directed portfolios are on average cheaper than an actively managed fund or portfolio MER. This makes sense given that there is no active management and no experienced, well-trained and proven portfolio managers making active decisions. They are simply using passive Exchange Traded Funds to mimic an index and slightly underperform the index after fees.

We are not saying there is anything wrong with this, the problem is that they are not using an apples-to-apples comparison. Many other fund providers also offer passive investment strategies with low fees, this is not something unique to self-directed brokerages. It is important to remember that these online brokerages also impose other fees on transactions as well, outside of the MERs. Since they are a discount broker, clients will have to pay for any and every additional service (buys, sells, switches, transfers, etc.). This is similar to a discount airline that will charge you for your bag, seat selection and maybe a bag of peanuts.

The other reason they are cheap is there is no professional advice attached to your portfolio outside of rebalancing investments. The importance of retirement, education, estate and tax planning are completely disregarded. Research shows that investor performance lags investment performance when investors do not have the benefit of ongoing advice… this means most investors long-term return is much lower than the products long-term return (from jumping in and out at the wrong times).

30% Wealthier – is this true?

With lower management fees and the avoided cost of an advisor over a 30-year period, surely this equals the 30% they are claiming… but how have these portfolios actually performed?

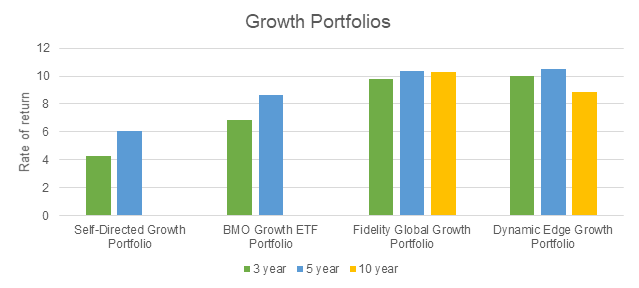

A certain self-directed investment brokerage states that with their growth solution, you will be 21% wealthier in 10 years by making sure you have low fees (using historical returns to project forward). Is this really the case? Let’s compare their growth portfolios to similar solutions within the industry that we frequently use;

*as of Jan. 31st, 2021 (net of fees) Series F

*self-directed returns as of Nov. 30th, 2020 (net of fees)[i]

As you can see in the performance comparison above, you would actually fall behind quite substantially with this self-directed growth portfolio compared to many of the options our clients hold, making “retire 30% wealthier” that much more misleading. Does this hold true for every growth solution on the market? Of course not. The purpose of this is not to tell you what future returns will be, because ultimately no one knows, and we never pretend to know. The purpose is to illustrate that picking an investment based on the lowest cost possible does not automate to success, as many times there is value added in those fees for active portfolio managers and investment professionals.

Remember, it’s important for investors not to be misled by these silly claims on TV, and sift through the facts to get a clear apples-to-apples comparison of investment products and services. The fact that these self-directed portfolios have underperformed many of their peers plus the fact that they don’t offer any personal financial advice (which has even more value for most investors) makes their ads quite misleading.

The Bottom Line – Yes, fees are very important.. but what are you getting for those fees? Active management, professional advice, client service and much more. As Warren Buffet famously said, “Price is what you pay, value is what you get”.

[i] Source: Questrade.com, BMO GAM, Fidelity Investments Inc., Dynamic Funds. Returns for BMO, Fidelity and Dynamic cover period from January 31st, 2011 to January 31st, 2021. Analysis conducted to perform comparison of investment performance solely, net of fees. As such, returns reflect Series F date for BMO, Fidelity and Dynamic portfolios.