“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.

– Albert Einstein

Even in the early 20th Century, Albert Einstein knew that compound interest had the potential to change lives. It is suggested that compound interest can work for or against you, depending on how you use it. If you are smart enough to use it to your advantage with long term investment management, it will make all the difference to achieving financial independence during retirement and later years of life.

Let’s look at a quick example;

Deposit five dollars a week for twenty years and let the interest accumulate. You will have actually put away only $5,200, but you will have $8,876.80. The difference of $3,676.80 is what 5% compound interest has done for you.

Now we understand its not easy to view small contributions to an RRSP, TFSA or company pension as life changing but as financial planners in Cornwall, we educate our clients on how they can achieve financial independence.

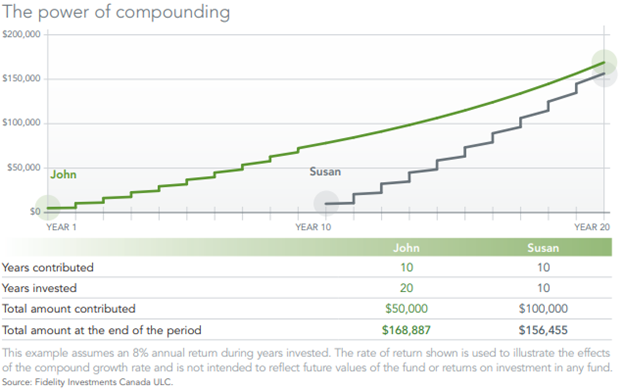

It’s very easy to put off investing. The common perception is that if you don’t have enough money to start investing now, it’s better to contribute more later and catch up on what you’ve missed. In fact, one of the best ways to build your wealth is to start as soon as you can – even if it’s only a small amount. Take into consideration the following example. We have two investors, John and Susan, who both hope to retire in 20 years and both of their investment plans generate the same 8% return.

John – In Year 1, John begins making annual contributions of $5,000 for 10 years. He stops investing after 10 years, and holds on to the investment for a further ten years, at an 8% annual return.

Susan – In Year 10, Susan worries about retirement so she starts making annual contributions of $10,000 for 10 years. She ends up with less than John at year 20, even though she invested twice as much money. This is caused by her “late start”.

This chart illustrated by Fidelity Investments shows us the sooner you invest, the more time your money has to grow and benefit from the power of compound interest. Time in the market is much more important than market timing.

What to hold for the long-term

When it comes to investment management, the risk of loss can be much higher for the short-term investor compared to the long-term investor. Many investors shy away from equity investments, fearing volatility. It’s true that over the short-term, equity returns can fluctuate substantially. Conversely, equities tend to become less volatile the longer you hold on to them. Putting at least some of your money in equities may give you a better chance of reaching your financial and retirement goals.

The longer you have to invest, the less of a concern volatility should be. While it’s very important to be aware of volatility, being too conservative may risk your long-term goals. Interest bearing investments (GIC’s, bonds, savings accounts) alone may not generate the growth and capital you will need to build your retirement nest egg – especially when inflation and taxes are factored in. Make sure you have a plan in place with your financial advisor or financial planner to account for this.