As our neighbours to the south go to the polls today, we thought that it would be timely to look at the impact that US Elections have HAD on your investments and THE financial markets as a whole. Every four years, investors inevitably focus on the possible outcomes of the election and what that MIGHT mean for their portfolio. Of course, Presidential elections influence the direction of public policy, but how much do they really impact your investments? Looking at history, the answer is – not as much as you may think.

It is important to remember that the financial markets start pricing in information as soon as it is available. What this means is that the most likely outcome of an upcoming event is already anticipated and accounted for in the market. This means that the financial markets have priced in election outcomes and are already looking further to the future. This isn’t to say that there won’t be increased volatility in the short term, but over the long-term, election results should have very little effect on a diversified portfolio.

Looking back at Trump’s victory in 2016, pessimism led to financial markets initially selling off, however, six months later they were up over 10% and continued to climb. Sticking to your investment plan and working with your financial advisor to manage emotions will help you avoid making costly knee jerk reactions, such as trying to time the market, which ultimately cost most investors money. As esteemed financial planner Nick Murray says, “Invest when you have the money. Sell when you need the money. Anything else is market timing, which is another term for madness”.

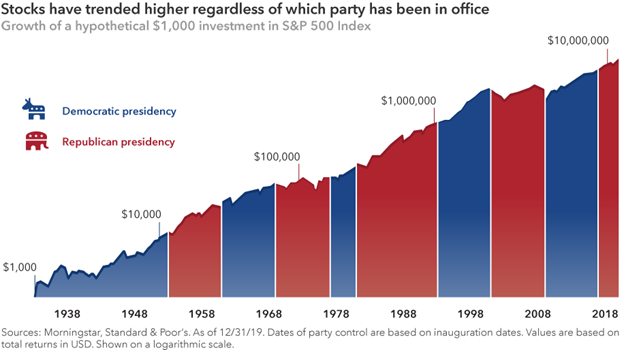

In the chart below, Capital Group Inc. takes a closer look at how the S&P500 Index has performed over the years depending on who occupies the White House.

“Presidents get far too much credit, and far too much blame, for the health of the U.S. economy and the state of the financial markets,” says Capital Group economist Darrell Spence. “There are many other variables that determine economic growth and market returns and, frankly, presidents have very little influence over them.”

Investor Behaviour

You may be thinking “Okay, but how does this impact me today?”. The number one reason most investors fail is that they let their emotions get in the way. In the end, the most important variable to investing success is also the only variable you can ultimately control: your own behaviour. YET, MANY of us put huge amounts of energy into variables that we cannot control.

In an election year, political campaigns often cause you to focus on what is wrong WITH ONE party OR ANOTHER, or the country as a whole. There is nothing wrong with wanting your candidate to win, but as we consume these continuous negative messages it is easy for emotions to rise to the surface and believe that the election outcome (one way or another) could be disastrous to our investment plan.

To be a successful investor you need to have emotional strength. Rising markets make us feel great, and falling market prices can bring on unnecessary anxiety. Leading into 2020, the last 10+ years have generally been favourable and relatively easy on our emotions.

So, remember, have a plan and stick to it. We have noticed over the last 20+ years that SOME people tend to trust their investment plan the least when they need it the most. During times of turmoil is not the time to toss out your strategy and cede control of your portfolio to your emotions. It’s human to trust your investment plan the least when you need it the most and be tempted to react to your emotions or the media. Please feel free to reach out to any of our Financial Planners and Advisors in Cornwall if you need assistance getting your investment plan on track.