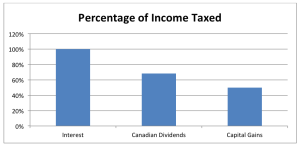

In the quest to grow wealth, many people believe they have to seek out the highest possible return for a given level of risk. However, our experience has taught us that most investors often overlook their real objective… which is to generate the most money after tax. The first step to understanding this is to understand that different types of income are taxed at different rates in Canada.

Our tax system has been designed to reward investors over savers. Those that grow their wealth through dividends and capital gains outside of registered plans will pay significantly less tax on their earnings. In the case of capital gains, another benefit is that this tax is deferred until the investment is sold (i.e. a realized gain) which can result in additional growth due to compounding. Let’s look a little closer at the types of income you can earn and how it is taxed.

Interest income

Each dollar of interest income is fully taxable at your marginal tax rate. This means that for investors at the top marginal rate of 49%, approximately half of an investor’s gain is eliminated after taxes. Interest on investments is included into your income on an accrual basis which means this tax is paid whether you receive the income or not. Gains made on treasury bills, stripped coupon bonds or other discount obligation must be reported as interest income.

Dividend income

The tax system recognizes that dividends are paid out of income on which the corporation has already paid income tax. To compensate for this, dividends of Canadian taxable corporations are subject to gross up/dividend tax credit treatment. The net effect is a significant reduction in the tax owing on dividend income.

Capital gains

A capital gain arises when you purchase a security or other capital property (i.e. shares of companies, real estate, etc.) at one price and sell it for more than you paid. The difference is called a capital gain. In Canada only one-half (i.e. 50%) of any net capital gain is subject to tax at your marginal tax rate. An additional tax benefit is that capital gains are allowed to grow and compound indefinitely as long as the security or property is not sold or “realized”.

Using our example above we can calculate that an investor who earns 7% interest on an investment of $10,000 will have to report $700 of interest income before tax. If they are in the highest marginal tax rate of 49.5% they will have to pay $346.50 in tax and be left with $353.50 in their pocket after tax.

Alternatively, an investor who realizes a capital gain of 5% on a $10,000 investment would have made $500 before tax. They would have to report one half of this gain for tax purposes or $250 and would have to pay 49.5% of that or $123.75 of tax. This would leave them with $376.25 ($500-$123.75) in their pocket and thus their 5% capital gain return would have netted them a better after-tax return than the 7% return from interest.

As you can see, from a tax point of view, interest is the least attractive way to receive income within a non registered portfolio. This simple example illustrates that it is critical to understand your tax rates and how your investments are taxed when making investment decisions outside of registered plans. Although this is a simplistic view, the benefits of deferring capital gains income for years and/or earning dividends can be much higher than those shown and should be understood (In Ontario, it’s possible for an individual with no other sources of income to earn approximately $40,000 in dividends per year without paying any tax at all!!).

Putting it all together

Confused yet? One of the key things we do as planners is to help our clients not only earn the best return they can for a given level of risk, but to also ensure they pay the least amount of tax that they can. If you have any questions about your investment plan or how you could pay less tax please don’t hesitate to give us a call. There are many ways to ensure you send less of your return to the government and the best way to do this is to have a comprehensive strategy in place because sometimes a 5% return can be better than a 7% return!