Remember: Patience is a virtue

Although the best investors understand the importance of patience, it is one of the most difficult skills to learn as an investor and portfolio manager. You’ll often hear the expression “patience pays off”, but what does that actually mean?

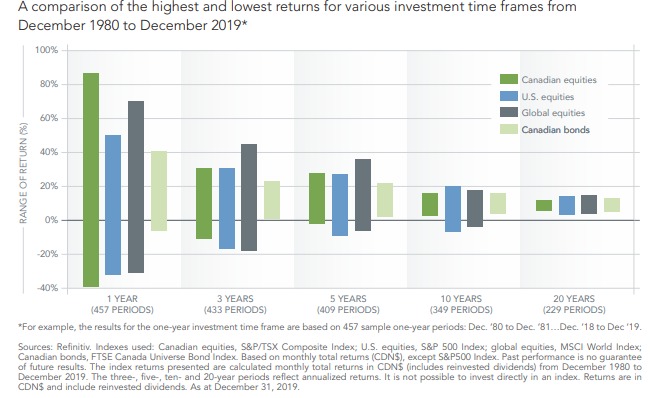

As investors, a good starting point is appreciating how long a long-term investment really is. One, three or five years isn’t that long when it comes to investing in the stock market. These short-term durations are barely enough time for investments to start smoothing out their short-term ups and downs. For a proper long-term outlook, 10 years or longer is a great starting point. While a decade may seem like a long time in other areas of life (and certainly is!), we realize as investors that staying disciplined during these durations is one of the most crucial factors of becoming a successful investor.

“The stock market is a device to transfer money from the impatient to the patient.”

-Warren Buffett

Many investors shy away from the stock market fearing volatility. As we know, equity returns can fluctuate substantially over the short term. Historically equities tend to be less volatile the longer you hold on to them, while continuing to provide the potential for growth. Time (and patience) reduces volatility of return. Looking at the chart below from Fidelity Investments, you can see the range of returns of assets vs the time horizon held. This shows that the longer your time horizon is, the higher your probability of positive returns.

Being a patient investor is tough, why?

- Information moves fast

- Is it possible things are moving too fast? Is the speed of information overwhelming the institutions and devices we count on to make sense of the world?

- It is easy to get information

- We are constantly connected to our phone, laptops, iPad’s, etc. with information being readily available, whether true or not

- People can easily share their views on how the market or a particular stock will move social media, podcasts, news outlets, commercials, blogs, newsletters, TV

Remaining patient and sticking to your plan is very difficult to do (especially in this age of media hype), but it is the hallmark of the great investor. Anyone attempting to invest for the future based on the recent past is falling into the classic trap of market timing and is participating in the most basic form of speculation. The following is a quote from Sir John Templeton who is arguably one of the most successful investment managers of the last century;

“Investors are the people who buy for fundamental value. Speculators are those who buy in the hopes of selling later to someone else at higher prices.”

If your goals have not changed (which is a way of saying: if your life and the lives of the people you care about haven’t changed) and if your portfolio is appropriate to your goals, why change it? The bottom line is that once you have properly set up your investment portfolio, managed in a disciplined way that suits your goals: DON’T CHANGE IT!

The goal from the outset is to try and minimize future changes and let the investment managers do their work. During market downturns like we’ve recently experienced, continue to have faith. This doesn’t mean that we just blindly hold forever, but strive to look at the performance of your investment portfolios with a realistic lens on the market environment and focus on the fundamentals of the companies you own.